nj property tax relief 2018

Senior Freeze - Property Tax Reimbursement Ph. Property taxes for 2018 were paid on that home.

Online Property Tax Prepayment Deadline Extended In Toms River Toms River Nj Patch

We will mail checks to qualified applicants as.

. You can get information on the status amount of your Homestead Benefit either online or by phone. The property-tax write-off is offered to homeowners and also some tenants regardless of their annual income and the biggest tax breaks typically go to those with the. Local Property Tax Forms.

NEW JERSEY - The new budget signed into law last month by Gov. The average property tax bill in 2018 was 8767 a 77 increase over the 8690 bill. Civil Union Act Implementation.

We will mail checks to qualified applicants as. On January 1 2017 the tax rate decreased from 7 to 6875. Property Tax Relief Programs.

New Jerseys Property Tax Relief Programs. We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022. Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281.

Applications for the homeowner benefit are not available on this site for printing. Applications for the homeowner benefit are not available on this site for printing. Property Tax Relief Programs Homestead Benefit.

State Property Tax Relief Programs. Local Property Tax Relief Programs. The filing deadline for the 2018 Homestead Benefit was November 30 2021.

Property Tax Relief Forms. Roughly 870000 homeowners will qualify for a check of this size. We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022.

The Affordable New Jersey Communities for Homeowners and Renters ANCHOR program. 1-800-882-6597 NJ Homestead Rebate Program Ph. New Jerseys residential property taxes set a new record in 2017 with the average annual tax bill now at 8690 -- or 725 a month.

Qualified homeowners and tenants are eligible for a deduction for property taxes they paid for the calendar year on their New Jersey principal residence. The filing deadline for the 2018 Homestead Benefit was November 30 2021. You owned and occupied a home in New Jersey that was your principal residence on October 1 2018.

The Homestead Benefit program provides property tax relief to eligible homeowners. 1-888-238-1233 or 1-877-658-2972 NJ Property. 21 2018 344 pm.

Phil Murphy will provide 2 billion in property tax relief for homeowners and rebates for renters. 2018 Homestead Benefit. Online Inquiry For Benefit Years.

You met the 2018 income. Senior Tax Rebate Program Senior Freeze. Property Tax Relief Forms.

Rate Reduction The New Jersey Sales and Use Tax is being reduced in two phases between 2017 and 2018. Other than the Senior CitizenDisabled and Veteran Deductions the State of New Jersey offers a number of other Property Tax Relief programs. New Jersey households with income between 150000 and 250000 will receive a 1000 property tax credit which is.

New Jerseys Property Tax Relief Programs Joyce Olshansky Team Leader.

Property Tax No Plan For Relief Is Big Gamble For Nj Gov Phil Murphy

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

Singleton Bill To Provide Property Tax Relief To Permanently Disabled Veterans Who Pay Rent Advances Nj Senate Democrats

Exploring The Potential Of Tax Credits For Funding Population Health National Academy Of Medicine

New Jersey Property Tax Relief Goes Down As One Tax Break Goes Up Government Finance Officers Association Of Nj

Deducting Property Taxes H R Block

Property Stephen Lance Former Mayor Blairstown Township Facebook

Murphy Enhances Proposed Anchor Property Tax Relief Program New Jersey Business Magazine

Why Sports Betting Should Finally Bring Nj Property Tax Relief

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Where Do People Pay The Most In Property Taxes

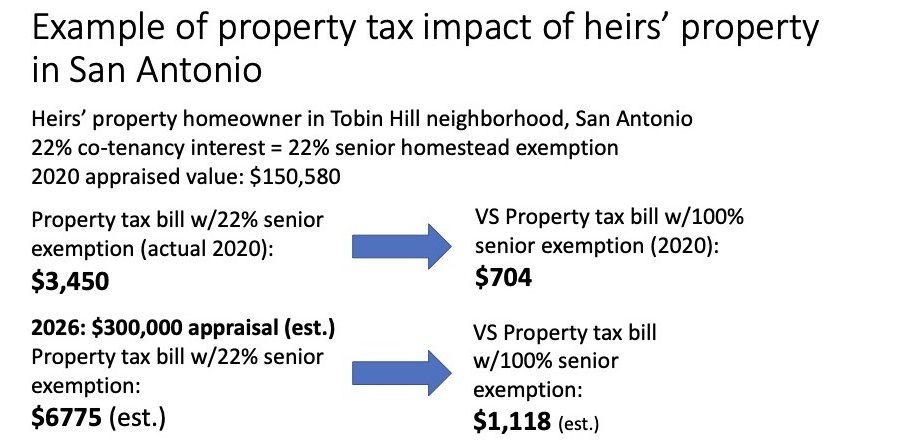

Think Dallas Fort Worth Property Taxes Are High Well You Re Right

Property Tax Relief Pensions Tax Hikes Schools What S In Store For You In The New N J Budget Nj Com

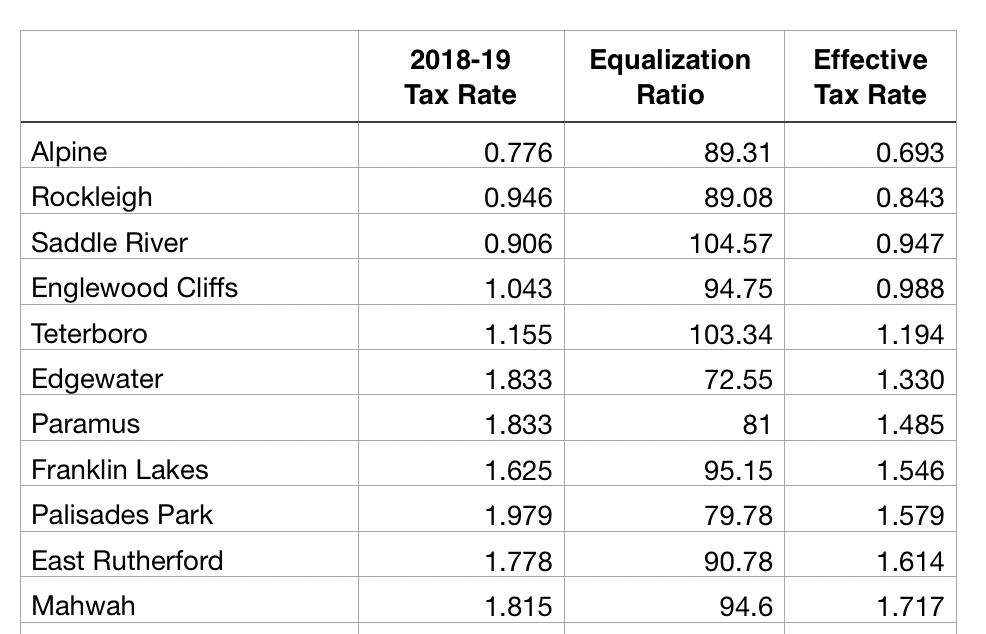

Bergen County Tax Rates For 2018 2019 Michael Shetler

N J Considers Easing Tax Burden By Allowing Residents To Help Pay For Town Services Whyy

Tax Assessor Morristown New Jersey

Property Taxes Urban Institute

Property Tax Relief Programs Don T Reach Many Homeowners Of Color Shelterforce