north carolina estate tax exemption 2019

Estate Tax What Is The Current Estate Tax Exemption Carolina Family. An addition is also required for the amount of state local or foreign income tax deducted on the federal return.

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

North Carolina also repealed its estate tax on January 1 2010 but it reinstated it a year later.

. Previous to 2013 if a North Carolina resident died with a large estate it might have owed both federal estate tax and a separate North Carolina estate tax. Put another way that means that you have a 998 chance of never having to worry about estate taxes. The exemption was then scheduled to continue to increase on an annual basis until it matches the federal estate tax exemption in 2019.

Annual income below 30200. 105-1641352 a State agency must obtain from the Department a sales tax exemption number. PDF 33315 KB - December 30 2019.

28A-27-5 - Exemptions deductions and credits. Owner or Beneficiarys Share of NC. Ad Download Or Email E-595E More Fillable Forms Register and Subscribe Now.

The exemption continued to increase annually until it matched the federal estate tax exemption in 2019. Skip to main content Menu. Complete this version using your computer to enter the required information.

The exercise of the powers granted by this Chapter will be in all respects for the benefit of the people of the State and will promote their health and. Any assets in excess of the estate tax exemption are subject to estate taxes as the estate tax rates in effect as of the date of the decedents death. 2019 North Carolina General Statutes Chapter 105 - Taxation Article 1A - Estate Taxes.

50 or the first 25000 of the appraised value exempt from taxation. Individual income tax refund inquiries. North Carolina Department of Revenue.

Streamlined Sales and Use Tax Certificate of Exemption Form. It is assessed against estates that exceed a given exemption amount. NC Gen Stat 131A-21 2019 131A-21.

The Internal Revenue Service IRS has announced the estate tax exemption and gift tax exemption amounts for 2019. Federal estate tax planning. Its at 59 million as of 2021 with a top tax rate of 16.

Free prior year federal preparation Prepare your 2019 state tax 1799. The federal taxable income of the fiduciary is the starting point for preparing a North Carolina Income Tax Return for Estates and Trusts Form D-407 and requires the same additions and deductions. Then print and file the form.

NC K-1 Supplemental Schedule. If your estate is larger than 114 million then the excess may be subject to the Federal. The estate and gift tax exemption is 114 million per individual up from 1118 million in.

Estates and Trusts Fiduciary. NC Gen Stat 28A-27-5 2019. 105-1537 for individual income tax.

Up to 25 cash back Update. And before April 15 2015. But Im happy to say that North Carolina does not have an estate tax.

Ad Free prior year federal preparation. 2019 North Carolina General Statutes Chapter 28A - Administration of Decedents Estates Article 27 - Apportionment of Federal Estate Tax. Beneficiarys Share of North Carolina Income Adjustments and Credits.

North Carolina estate tax. The Federal gift tax exemption will remain 15000 annually for the time being. Art firearms historic memorabilia and other collectibles may be subject to certain taxes.

Purchasers Affidavit of Export Form. The state exemption amount was tied to the federal one which means that for deaths in. PO Box 25000 Raleigh NC 27640-0640.

But dont forget the federal estate tax still exists. The 2019 Federal estate tax exemption will be 114 million. PO Box 25000 Raleigh NC 27640-0640.

The Estate Tax Exemption. If you qualify you can receive an exclusion of the taxable value of your residence of either 25000 or 50 whichever is greater. A set of North Carolina homestead exemption rules provide property tax relief to seniors and people with disabilities.

2019 North Carolina General Statutes Chapter 131A - Health Care Facilities Finance Act 131A-21 - Tax exemption. Even though North Carolina does not currently impose an estate or inheritance tax if the decedent bequeathed out-of-state assets to surviving family taxes in the alternate jurisdiction might apply. Qualifying owners must apply with the Assessors Office between January 1st and June 1st.

Homestead exemption for elderly and disabled. Trusts and estates are taxed at the rate levied in NC. It later turned around and repealed the tax again retroactively to January 1 2013.

North carolina estate tax 2019. The tax rate on funds in excess of the exemption amount is 40. As of 2021 the exemption sits at 2193 million and the top tax rate is 20.

The Internal Revenue Service announced today the official estate and gift tax limits for 2019. Federal estate tax could apply as well. Current Federal Estate Tax Exemption.

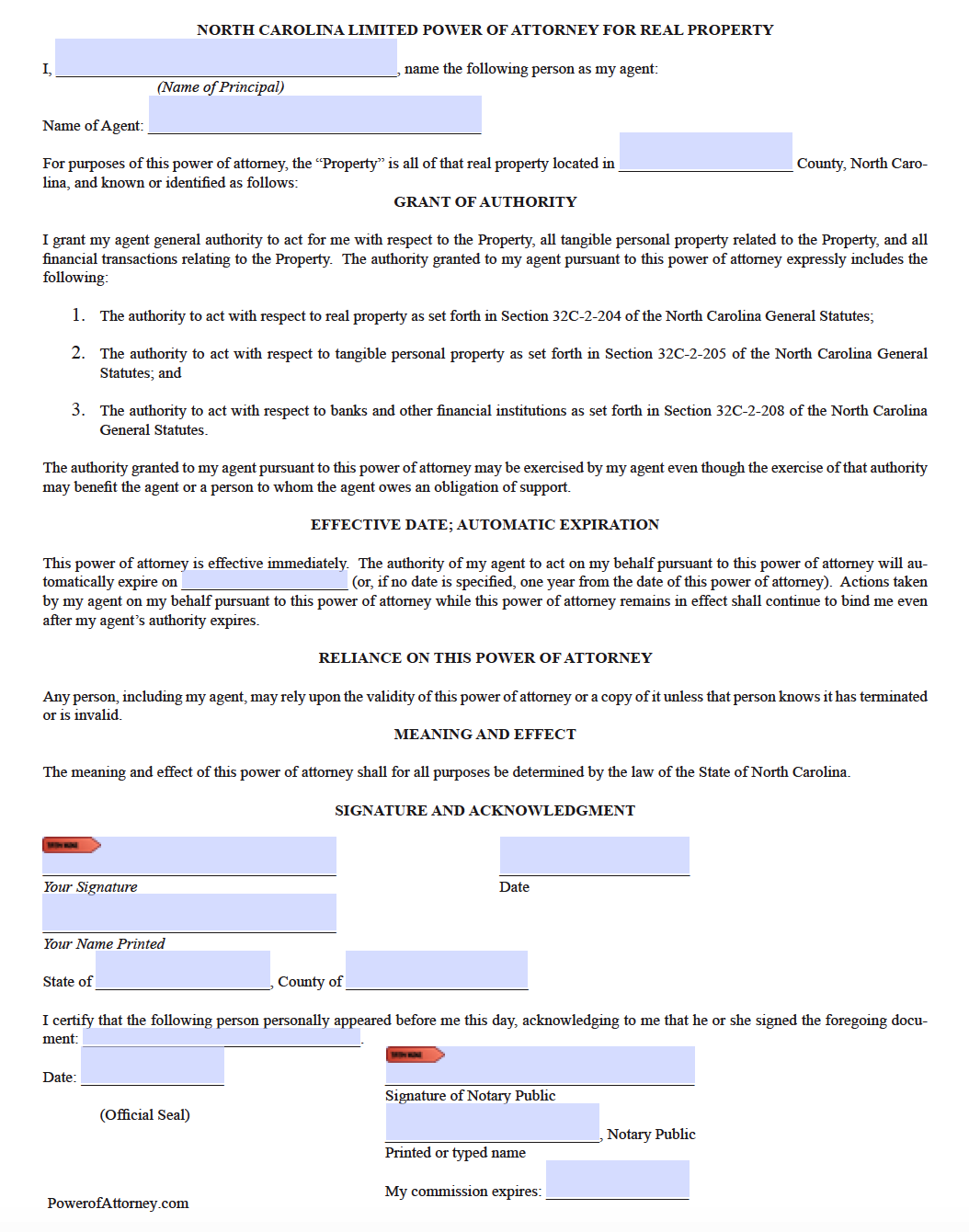

Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Circuit breaker tax deferral for elderly or disabled. Link is external 2021.

- To be eligible for the exemption provided in GS. If you are totally and permanently disabled or age 65 and over and you make. As of January 1st of the year for which.

Application for Extension for Filing Estate or Trust Tax Return. Effective January 1 2013 the North Carolina legislature repealed the states estate tax. Estate tax is often called the death tax.

65 years old or oldertotally and permanently disabled. Instantly Find and Download Legal Forms Drafted by Attorneys for Your State. North Carolina Department of Revenue.

For Tax Year 2019 For Tax. Even though estate taxes are the subject of much debate and many people dont like the idea of the estate tax estate taxes affected less than 14 of 1 018 if you are keeping score of all decedents in 2015. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

105-321 - Repealed by Session Laws 2013-316 s7a effective January 1 2013 and applicable to the estates of decedents dying on or after that date. On April 1 2014 New York made significant changes to its estate tax laws by increasing the states exemption to 2062500. The application for exemption must be in the form required by the Secretary be signed by the State agencys head and contain any information required by the Secretary.

65 years old or oldertotally and permanently disabled. North Carolina does have income tax but it doesnt have an estate tax or gift tax. So thats one thing less for residents to consider.

114 million exemption for 2019 for all other transfers. North Carolina allows low-income homestead exclusions for qualifying individuals. The current Federal Estate Tax Exemption for 2021 is 117 million per individual.

Prepare your 2019 North Carolina return for 1799.

The Ultimate Guide To North Carolina Property Taxes

North Carolina Bill Of Sale Pdf Templates Jotform

Monroe North Carolina Facebook

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

North Carolina Tax Reform North Carolina Tax Competitiveness

North Carolina Gift Tax All You Need To Know Smartasset

North Carolina Providing Broad Based Tax Relief Grant Thornton

Free Real Estate Power Of Attorney North Carolina Form Adobe Pdf

12 Best Places To Live In North Carolina

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Tax Reform North Carolina Tax Competitiveness

North Carolina State University Raleigh

National North Carolina Day September 28 2022 National Today

Nc Commerce Nc Annual Economic Report Gross Domestic Product

North Carolina Low Income Tax Clinic Charlotte Center For Legal Advocacy

North Carolina Notary Public Manual 2016 Print Version Unc School Of Government